The Portrait of Gold, History, and Power

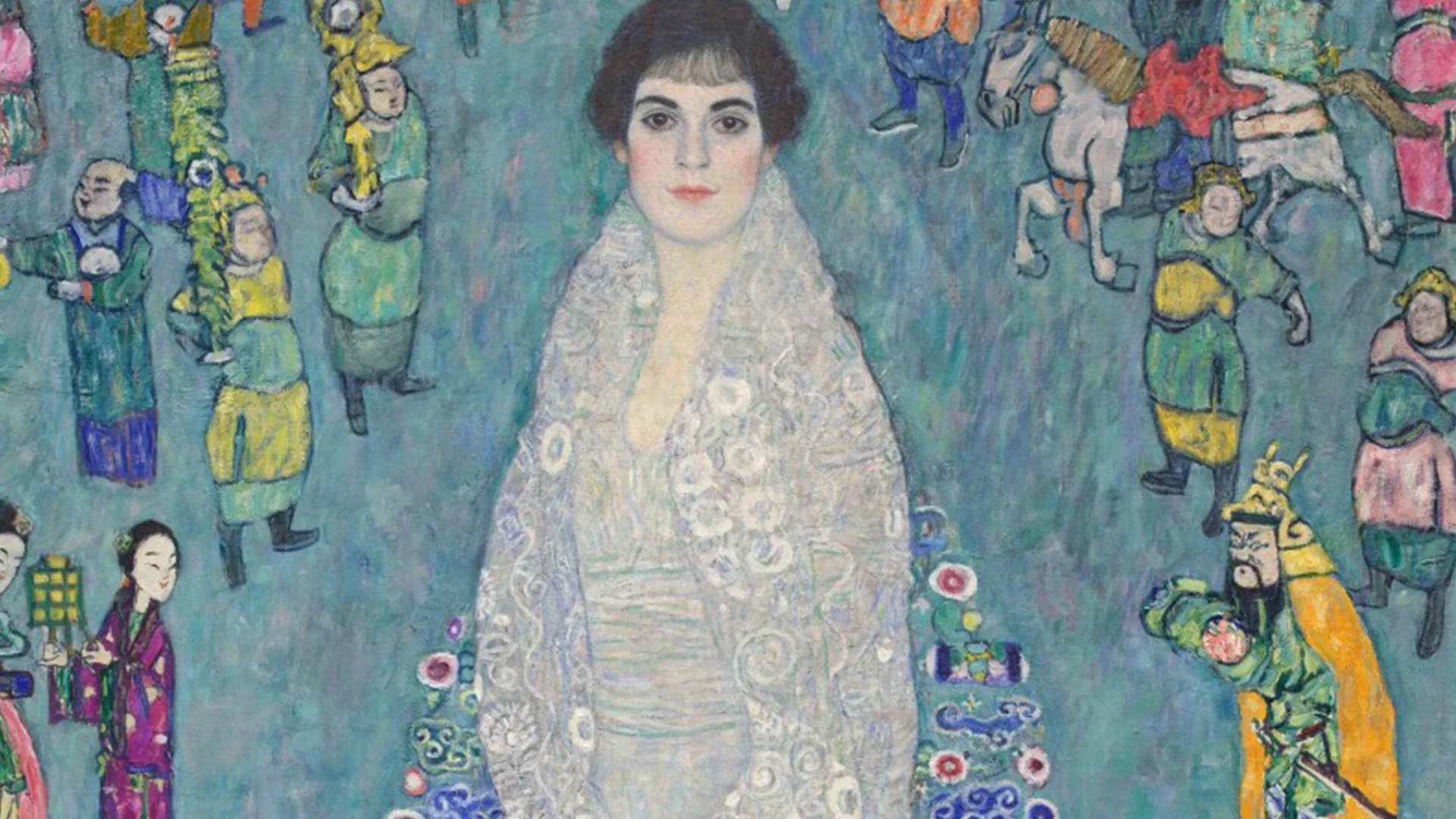

Gustav Klimt’s Portrait of Elisabeth Lederer reached US$236.4 million, revealing how provenance, rarity, and history now shape the highest tier of art-market value.

Words Randolf Maala-Resueño

Photos courtesy of Sotheby’s

January 04, 2025

When Gustav Klimt’s “Portrait of Elisabeth Lederer” sold for 236.4 million US dollars at Sotheby’s earlier this November 2025, it instantly rewrote the auction record books. The result positioned the painting as the most expensive work of modern art ever sold publicly, and the second-most expensive painting of any era to cross the auction block.

But prices of this scale do not exist in isolation.

They are signals, read closely by collectors, dealers, insurers, and institutions looking to understand where confidence now concentrates in a cautious global market. The sale reaffirmed that trophy works still command extraordinary liquidity.

More importantly, it demonstrated that buyers are no longer paying for names alone—it is a layered narrative of rarity, history, and moral clarity.

Portraiture, power, and scarcity

Klimt’s portraits occupy a distinct tier within the modern canon. They fuse ornamental splendor with psychological intimacy, offering collectors both visual impact and cultural authority.

“Portrait of Elisabeth Lederer” stands out even within this elite group. Few large-scale Klimt portraits remain in private hands, and fewer still carry such extensive documentation, exhibition history, and scholarly consensus.

Scarcity, in this context, it’s qualitative—defined by condition, provenance, and the ability of a work to function as a museum-quality anchor within a private collection.

At auction, this scarcity translates into urgency.

Bidders are not simply competing against one another but against time, knowing the opportunity may not return within their lifetimes.

Provenance as value architecture

A photo of Serena Lederer standing in front of her daughter's portrait at her salon, captured by Martin Gerlach about 1930. (Photo courtesy of Getty Images/brandstaetter)

The Lederer portrait carries a provenance inseparable from twentieth-century European history. Commissioned by a prominent Jewish family, the work was later seized during the Nazi era before eventually being restituted.

In today’s art market, restitution histories did not diminish work value but valiantly intensify it.

Collectors increasingly understand provenance as ethical architecture. Clear ownership, documented recovery, and transparent stewardship provide not only legal security but cultural legitimacy. Auction houses now foreground these narratives deliberately. They recognize that moral clarity enhances confidence, particularly at price levels where reputational risk is as significant as financial exposure.

For institutions, such works offer educational gravity. Yet for private buyers, they offer both historical responsibility and enduring relevance.

What US$ 236.4 million really buys

The final price now flows to the tenets of modern art as a stable asset class at its highest tier. Such results recalibrate benchmarks across the market. They influence valuation models, insurance ceilings, loan agreements, and the terms under which museums negotiate long-term exhibitions.

They also shape seller psychology. Owners of comparable works reassess timing, while heirs reconsider whether to sell privately, donate, or test the auction floor.

For Sotheby’s, the sale reinforces the power of curated storytelling. And for collectors, in return, it underscores the premium attached to works that unite beauty, rarity, and unambiguous history.

A Klimt of this caliber fundamentally resets expectations.

At US$ 236.4 million, “Portrait of Elisabeth Lederer” became: one, a financial benchmark; and, ultimately, a cultural statement. It reminds the market that the most valuable art is understood, contextualized, and preserved as legacy.

In an era of volatility, that clarity may be the most precious asset of all.