The Magic Formula Behind What Really Makes Art Worth Millions

Words Eric Jurado

October 22, 2024

Simon de Pury. Image - Forbes

De Pury stresses that even the most enthusiastic collectors derive little pleasure from watching the value of their acquisitions plummet. To avoid this, a certain level of due diligence is essential. With this in mind, he has developed a magic formula with a set of 14 criteria that can help assign financial value to a piece of art. While the first factor is driven by emotion, the rest are rooted in reason. For collectors with an eye on investment, it’s worth considering how a potential acquisition measures up against each of these points.

The Magic Formula Factors

1. EMOTION

Art, like people, emits its own energy. Occasionally, a piece captivates us, leaving us restless until it becomes ours—assuming it’s not already housed in a museum. This connection is deeply personal and subjective, and it’s what makes art irresistible to many.

Key Question: How strongly does the piece emotionally resonate with collectors or the public?

2. QUALITY

Even the greatest artists don’t create masterpieces every day. Variations in the quality of an artist’s work can drastically impact its value. For instance, while Pierre-Auguste Renoir is celebrated for his Impressionist masterpieces, he also produced a number of mediocre works. During the 1980s, these lesser pieces soared in value alongside his best works, leading to disappointment for some buyers in the years that followed when prices for those mediocre pieces crashed. The lesson here? Trust your eyes, not the hype.

Key Question: What is the artistic quality of the piece compared to the artist’s best works?

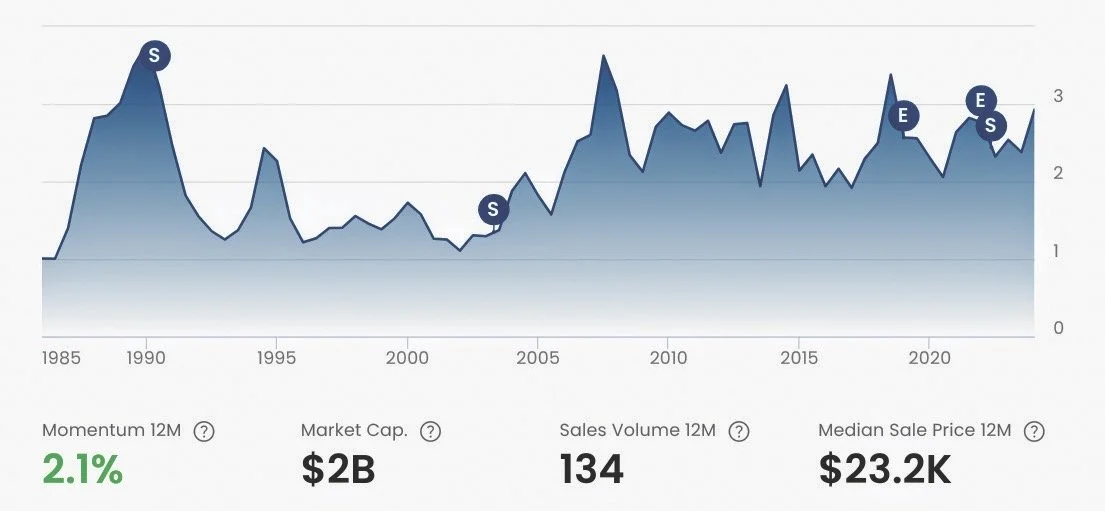

US$1 invested in an average artwork by Pierre-Auguste Renoir in January 1985 grew 205% (2.9% per year) to US$3.05 in May 2024.

3. AUTHENTICITY

If a work is a forgery, it has no financial value. Buyers must exercise caution and verify the authenticity of a piece before purchase. Top auction houses and galleries offer a degree of protection, but even the most reputable firms can occasionally slip up. The 2020 Netflix documentary Made You Look: A True Story About Fake Art highlights just how easily forgeries can make their way into the market.

Key Question: Is the artwork verified as genuine and well-documented?

4. RARITY

An artist’s work must strike a balance between availability and scarcity. Artists like Picasso and Warhol have maintained top-selling positions for decades, partly due to the breadth of their work. While a sufficient number of pieces are available for sale, their diverse output ensures continued interest. In contrast, artists whose works lack variety or evolution may struggle to maintain value.

The market value of all of Pablo Picasso’s artworks that have entered the global auction market reached US$13.3 billion in June 2024. US$1 invested in his average artwork in January 1985 grew 1,071% (6.5% per year) to US$11.71.

Key Question: How rare is the artwork in terms of availability and uniqueness?

5. CONSERVATION

Even masterpieces aren’t immune to the ravages of time. Proper conservation is crucial to preserving a work’s value. A piece in pristine condition will typically fetch a higher price than one that has deteriorated. Often, the true state of an artwork can’t be judged by the naked eye, making a professional condition report essential before purchasing.

Key Question: What is the physical condition of the artwork?

6. SIZE

In the art world, bigger isn’t always better. Larger works (more than three meters high) can be difficult to display in most homes, driving up storage and transportation costs. Unless you have grand spaces with towering ceilings, smaller, more manageable pieces are often more desirable.

Key Question: Is the size appropriate for collectors or gallery display?

7. PROVENANCE

A work of art’s history—its “résumé”—can significantly influence its value. Previous ownership by prestigious figures or institutions can elevate a piece’s worth, as seen in the exorbitant prices fetched for Andy Warhol’s cookie jars and the Duke of Windsor’s cufflinks.

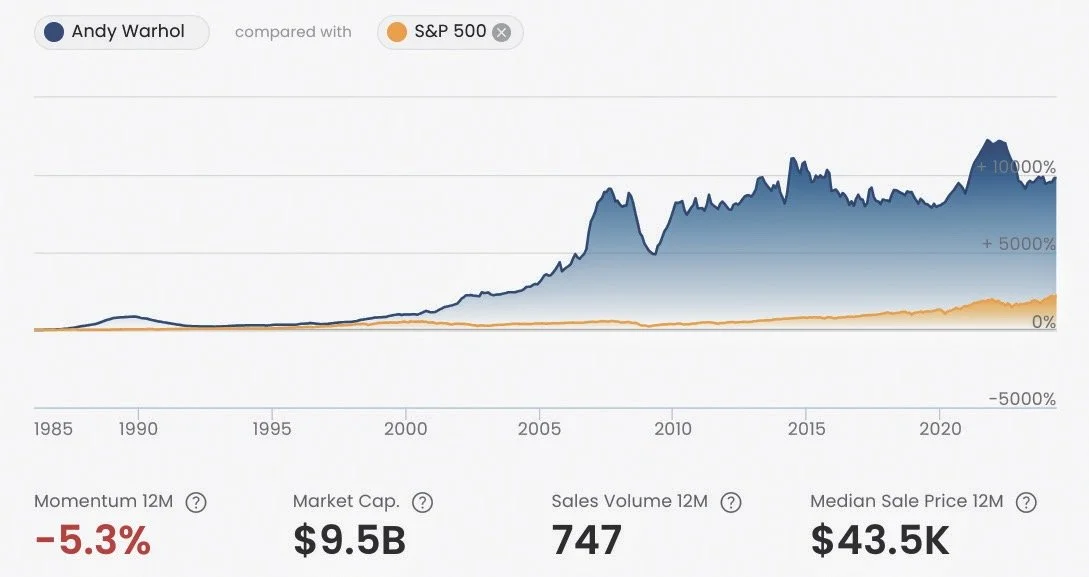

US$1 invested in an average artwork by Andy Warhol in January 1985 grew 9,805% (12.5% per year) to US$99.05 in May 2024, outperforming a US$1 investment in the US stock market (S&P 500), which grew 2,226% (9.1% per year) to US$29.38.

Key Question: Does the artwork have a prestigious or significant ownership history?

8. TASTE

Taste in art is ever-evolving. What is considered fashionable today may not hold the same appeal decades from now. When de Pury first entered the business, collectors were drawn to 18th-century French furniture. Today, contemporary art paired with mid-20th-century design dominates the homes of the super-wealthy. Failing to recognize the shifts in taste can be a costly mistake for any art investor.

Key Question: Is the artwork aligned with current trends and tastes in the art world?

9. TASTEMAKERS

Influential gallery owners and cultural figures play a critical role in shaping the market. Larry Gagosian, who represents more than half of the contemporary artists featured at major auction houses, is a key tastemaker in the art world. Others, like Charles Saatchi, Pharrell Williams, or K-pop star Choi Seung-hyun (better known as T.O.P), also wield significant influence over what’s considered desirable. Bernard Arnault, the founder, chairman, and CEO of LVMH Moët Hennessy Louis Vuitton, commands a marketing empire far beyond the reach of the art world’s top professionals. His influence is so vast that he has become the ultimate arbiter of global taste.

Key Question: Are key influencers or cultural figures advocating for this artist or piece?

10. MARKET MAKERS

Those who spend the most money in the art world have the power to set the market. For instance, Sheikha Al-Mayassa bint Hamad Al Thani’s extensive cultural investments in Qatar have cemented her as one of the foremost market makers. Her influence is comparable to that of historic figures like Catherine the Great.

Key Question: How active are major buyers or institutions in acquiring works by this artist?

11. GLOBAL MARKET REACH

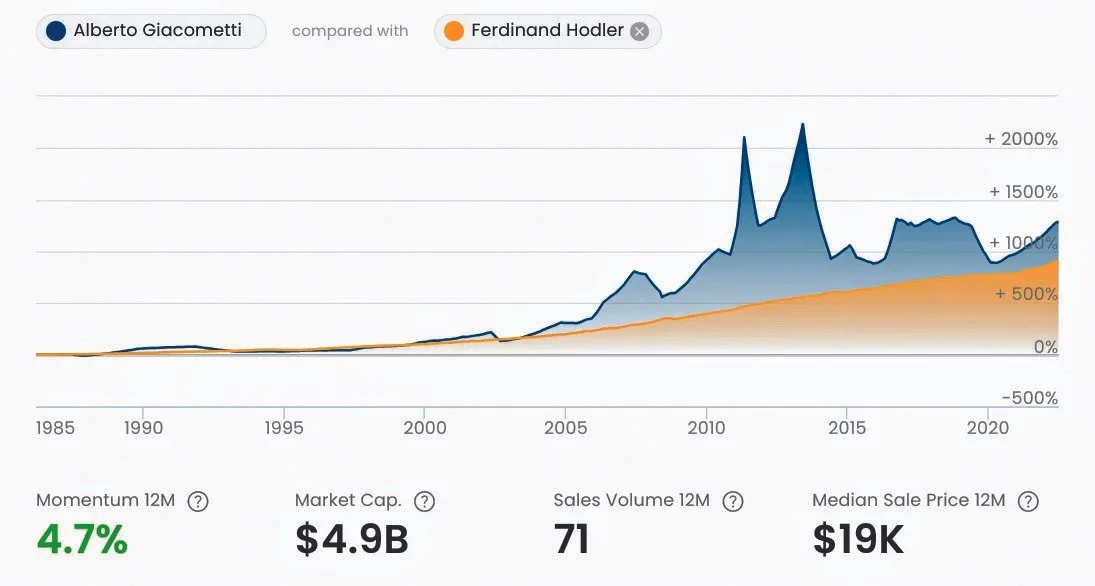

US$1 invested in an average artwork by Alberto Giacometti in January 1985 grew 1,285% (7% per year) to US$13.85 in July 2024, outperforming a US$1 investment in an average artwork by Ferdinand Hodler, which grew 905% (6.1% per year) to US$10.05.

The geographic reach of an artist’s market impacts their value. An artist whose work is collected globally—like Alberto Giacometti— commands higher prices than one with equal talent whose work remains confined to a local or national market, such as Swiss painter Ferdinand Hodler.

Key Question: Is the artist’s work in demand globally, or limited to specific regions?

12. LEGISLATION

In some countries, restrictive legislation can greatly diminish the value of an artwork. If a piece is declared a national treasure and can’t be exported, its market value takes a significant hit, almost akin to confiscation.

Key Question: Is the artwork free from restrictive laws that affect its sale or movement?

13. MARKETING

Even the finest masterpieces require marketing to reach their full potential in terms of value. Buyers are constantly bombarded with choices, and without proper marketing, even the most significant works can be overlooked.

Key Question: How well has the artwork or artist been marketed to potential buyers?

14. AUCTIONEER

The auctioneer handling the sale can have a surprising impact on the final price. Like artists, auctioneers have good days and bad days, and a skilled one can extract an extra bid that might push a piece beyond its expected value.

Key Question: Is the auctioneer highly skilled and experienced in selling high-value works?

By understanding these 14 factors, collectors and investors alike can make more informed decisions, ensuring that their passion for art doesn’t come at the cost of financial loss.

The Magic Formula

Here’s the magic formula that assigns a point system to each of Simon de Pury’s 14 factors to estimate the potential value of an artwork. You can score each factor on a scale from 0 to 10, where higher scores indicate a stronger influence on value. The total score gives a rough estimate of how valuable a work of art might be.

ART VALUE POINT SYSTEM

1. Emotion (0-10 points)

• How strongly does the piece emotionally resonate with collectors or the public?

• 10 = Captivates attention universally, 0 = No emotional impact.

2. Quality (0-10 points)

• What is the artistic quality of the piece compared to the artist’s best works?

• 10 = Masterpiece, 0 = Poor quality within the artist’s oeuvre.

3. Authenticity (0-10 points)

• Is the artwork verified as genuine and well-documented?

• 10 = Verified authentic with strong documentation, 0 = Potential forgery.

4. Rarity (0-10 points)

• How rare is the artwork in terms of availability and uniqueness?

• 10 = One of a kind or very limited in number, 0 = Mass-produced or common.

5. Conservation (0-10 points)

• What is the physical condition of the artwork?

• 10 = Perfect condition, 0 = Significant damage or deterioration.

6. Size (0-10 points)

• Is the size appropriate for collectors or gallery display?

• 10 = Ideal size, easily displayed, 0 = Too large or impractical to store.

7. Provenance (0-10 points)

• Does the artwork have a prestigious or significant ownership history?

• 10 = Previously owned by famous collectors or institutions, 0 = No significant history.

8. Taste (0-10 points)

• Is the artwork aligned with current trends and tastes in the art world?

• 10 = Highly desirable in today’s market, 0 = Out of fashion.

9. Tastemakers (0-10 points)

• Are key influencers or cultural figures advocating for this artist or piece?

• 10 = Strong support from tastemakers, 0 = No attention from influencers.

10. Market Makers (0-10 points)

• How active are major buyers or institutions in acquiring works by this artist?

• 10 = Frequently sought after by major collectors, 0 = No market interest.

11. Global Market Reach (0-10 points)

• Is the artist’s work in demand globally, or limited to specific regions?

• 10 = Global appeal, 0 = Confined to local or niche markets.

12. Legislation (0-10 points)

• Is the artwork free from restrictive laws that affect its sale or movement?

• 10 = No restrictions, 0 = Declared a national treasure, cannot be exported.

13. Marketing (0-10 points)

• How well has the artwork or artist been marketed to potential buyers?

• 10 = Strong marketing campaign, 0 = No marketing or awareness.

14. Auctioneer (0-10 points)

• Is the auctioneer highly skilled and experienced in selling high-value works?

• 10 = Renowned auctioneer with a track record of record-breaking sales, 0 = Unproven or ineffective auctioneer.

Scoring:

• Perfect Score: 140 points

• High Value: 100–140 points

• Moderate Value: 60–99 points

• Low Value: Below 60 points

Note: If you scored 0 for authenticity (a potential forgery), then the artwork has no financial value.

By applying this magic formula, you can estimate the potential financial value of an artwork based on how well it performs across these key factors.